I have always been the kind of person who worries a lot about money, to the point where it’s a preoccupation. Sure, a lot of this is because I’ve always had a job that comes along with significant uncertainty – I never know what the next year (or even the next month) of my life will look like, financially speaking – but still: for years and years (until pretty recently, actually), I made my life far more stressful than it had to be by putting off the decision to come up with an actual plan.

When things are going well – money’s coming in, no major unexpected expenses are popping up – it’s easy to sail along in a happy bubble of obliviousness; I know this first-hand, because I’ve spent a lot of time hanging out in that bubble. But then – inevitably – the bubble pops. And you find yourself in a world of pain.

As an example, I thought I’d tell a story I’m not sure I’ve ever touched upon here, even though I’ve certainly been asked about it plenty over the years. (Spoiler: it’s about my dog. But stay with me; I’m going somewhere with this.)

When I first started Ramshackle Glam and began posting photos of my friends, my family, and my one-eyed puppy, Lucy, I started getting comments and questions asking what had happened to Lucy’s eye. I sidestepped the questions because the real answer was that it was extremely painful to talk about, in part because what happened was sort of my fault (I’ll explain), and because at that age my skin was far too thin to let me open up commentary on a subject I was so sensitive about. But with all this lovely age and theoretical wisdom has come an understanding that everyone makes mistakes, and that the best thing you can do when you make one is acknowledge it, and then learn from it.

So here’s what happened to Lucy (note: please don’t read this if you’re feeling squeamish, ok?). It was around noon on a weekday, and I was home alone working on an editing project when I decided I wanted an apple. Except I didn’t have any, so I decided to drive to the bodega located two blocks away (everyone in LA does this; it’s ridiculous and also completely automatic). I reversed out of my driveway, backed into the street, pushed the gearshift into drive – and heard a whine.

Many hours later, I discovered that Lucy had crawled through a hole under my backyard fence and had followed me out to my car before hiding underneath it, but when I heard that whine all I knew was that I had just hit my six-pound puppy. I’m absolutely certain that the world started moving in slow motion from that point on; I remember looking up and watching Lucy zooming towards the house, and somehow she ended up in the house and I ended up in the house, but I don’t remember opening the door. I definitely remember what she looked like when I found her behind my couch, because her left eye was sitting on her cheek (sorry). I think what happened next was that I ran into the street yelling “Somebody help me!” at a bunch of empty suburban houses, then somehow located the car keys that I’d dropped on the lawn and drove to the vet without getting into a car accident. Lucy went into surgery, and her eye was put back where it was supposed to go, and then a week or so later it came out again, and had to be removed completely.

This is a horrible story. It was a horrible moment in my life (and obviously in Lucy’s – and Francesca’s, because we were living together at the time this happened and because Lucy is our shared first child). But it was also horrible for another reason: because – and this is not a fun thing to admit – even as I was sitting in the waiting room at the vet, crying and wondering whether my dog would live, a thought was circling in my head that made me feel not just panicky, but ashamed:

How much was this going to cost me?

The answer ended up being about six thousand dollars. Six thousand dollars that, as a 26-year-old only-occasionally-working actress, I did not have, but had to come up with anyway. And because I’d never put aside any money in expectation of an incident like this, that one horrible, completely unforeseen moment left me spinning financially for the better part of a year. More immediately, however, it added panic about money to an already overwhelmingly emotional moment when finances should have been the last thing on my mind.

The financial fitness worksheet you should probably take a look at.

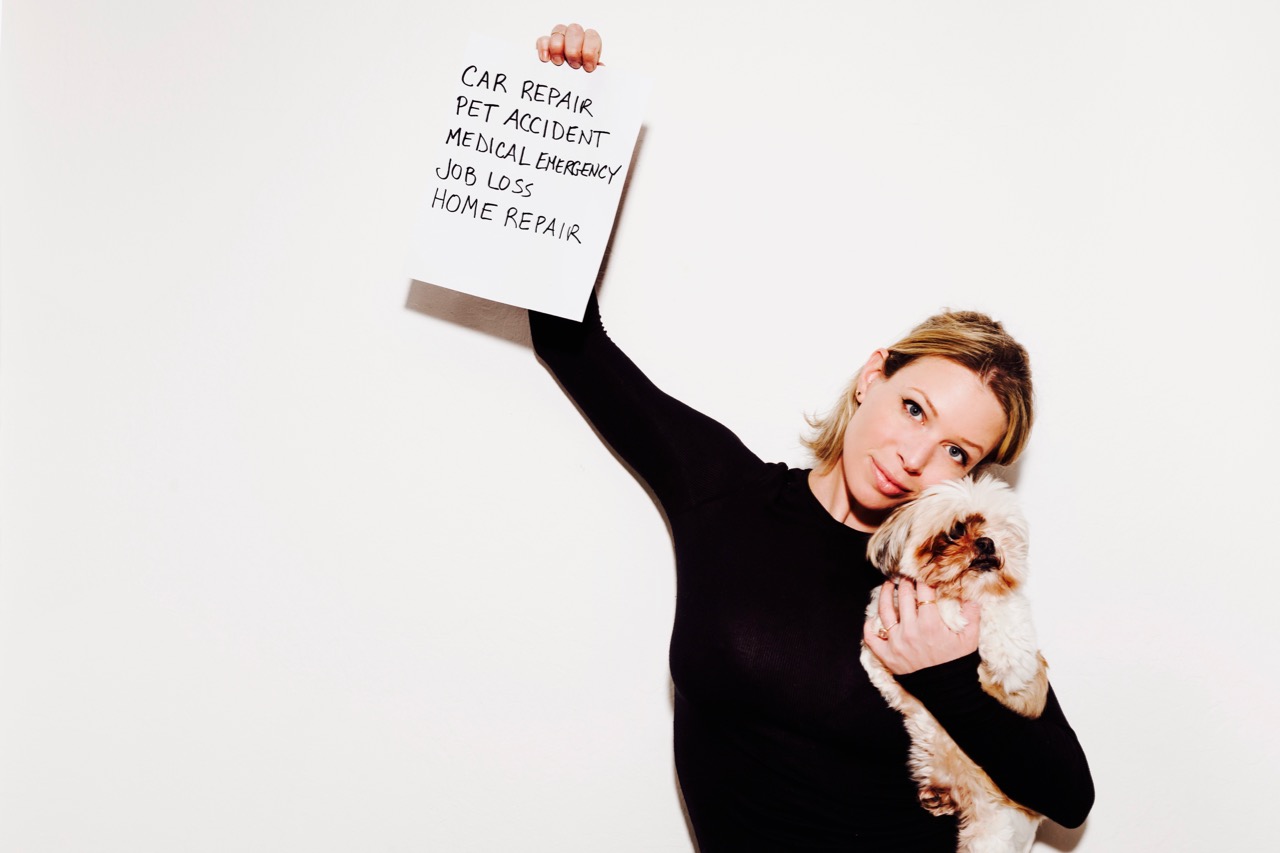

The reality is that these unexpected expenses – home repairs, medical emergencies, pet accidents, car issues – happen to all of us, and they tend to happen more often than we’d think (and definitely more than we like). We don’t see these mini – or major – disasters coming. We have to prepare for them anyway.

So now that I sound sufficiently apocalyptic, let’s switch gears away from depressing, stomach-churning stories of dog eyeballs (the story ends with Lucy being totally fine and possibly the happiest little fluff that ever lived, btw), and focus on how to prevent you from going through something similar. The first step: go fill out THIS FINANCIAL FITNESS WORKSHEET OVER ON NORTHWESTERN MUTUAL. I know; the idea of looking at anything titled “Financial Fitness Worksheet” makes me want to fall asleep, too. It makes everyone want to fall asleep – which is why this one is structured to be both informative and fun. The next step: use the tips to help you set specific, achievable financial goals regardless of where your finances are at this exact moment. And don’t underestimate the value of meeting with a professional; Kendrick and I did this a few years ago to help us get on track, and it had an immediate and concrete impact on our spending choices.

I filled out the worksheet (which you can download yourself HERE) and based on my results I came up with the following goals. (Caveat: my results would have been VERY different in my twenties; the past couple of years have shocked me into being way more on top of my finances than I used to be.)

![]() PERSONAL FINANCIAL GOALS

PERSONAL FINANCIAL GOALS ![]()

- 1-2 years: Work towards relying less on my (unstable) income and more on Kendrick’s (stable) one for monthly expenses, allocating the majority of what I make to savings to cover income fluctuations, savings towards home improvement, and savings for our kids’ college accounts.

- 3-10 years: Have sufficient income and/or savings to either send our children to private school, or to move to a better middle-school and high-school school district. A move to a slightly larger home or home expansion (a second level) are also medium-term goals.

- 11+ years: Financial stability, which to me means living below our means (rather than right at the edge of them) so that we can allocate a set amount of monthly income towards college, retirement, and other large, long-term expenses.

So that’s me. I love this topic, as I’m sure you know by now – I think our culture is way too touchy about discussing money, and that the best thing we can do to secure our financial futures is to just confront them honestly and openly – and would love to hear any questions you have about my personal goals, or thoughts you have about your own.

(Happy girl.)

This is a sponsored conversation written by me on behalf of Northwestern Mutual. The opinions and text are all mine. (Photos by Sue Hudelson.)